Tags: accounts, bookkeeping, government, HMRC, making tax digital, NIC 2, returns, Revenue, self assessment, SME, tax, tax return

HMRC Announce Plans to Increase Support for Mid-Sized Businesses

This week HMRC have announced they are to increase support for mid-sized businesses to help as they move towards expansion. In order to qualify these businesses must have more than 20 employees or a turnover of over £10 million. This new Growth Support Service will offer specialist tax experts’ advice tailored to the individual business. If you meet the criteria you can apply online. This service follows the introduction of the Small Business Online Forum last month. This online service provides support for newly launched businesses and those self-employed. If you require one-to-one support with your financial records or would

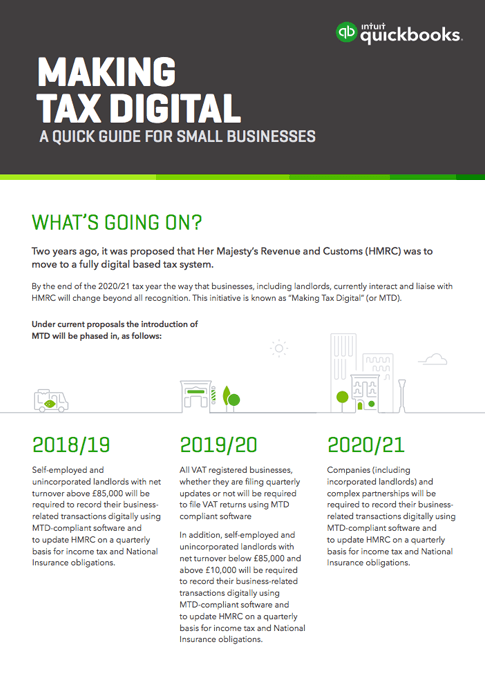

Making Tax Digital

Two years ago it was proposed that HMRC was to move towards a fully digital based tax system, making tax digital or MTD for short. This affects all businesses and by the end of the tax year 2018/19 these changes may affect you and your business. By 2020/21 all businesses will be affected. These changes are coming and you will be expected to update HMRC every quarter. Quick Books have produced a guide which can be downloaded here. HMRC have information on their website regarding these changes. If you have any queries as to how you will be affected and

Making Tax Digital for Business…and You!

In a little over a year, many businesses will be required to keep digital records of their finances. Sole traders, small businesses, including landlords and the self-employed, will be required to keep records of their income and expenditure digitally, and send summary updates quarterly to HMRC from their software or app. It is estimated that £8billion is lost to HMRC each year due to avoidable taxpayer errors. This failure, along with the drive to turn the department into a modern digital online service provider are the objectives behind the changes. Contact Jenny at JMJ Bookkeeping for full details of what the

Deadline in January Don’t be Caught Out

The next deadline for submitting your tax return falls on 31 January and this is for online submissions. Don’t forget about this deadline. If you have any queries regarding your tax affairs please contact us. We can help with personal and business tax returns and ensure that your financial records and books are up to date. Don’t fool yourself into thinking the deadline is open to negotiation. HM Revenue and Customs reveal here the top 10 worst excuses for missing the deadline. If you are planning to make 2017 the year you take the plunge into self-employment, speak to us.

Deadlines for Tax Returns 2016

Different ways to submit your tax return Depending on how you choose to submit your tax return, the deadline for submitting it will be different. Paper tax returns need to be filed by 31 October. So for tax returns relating to the year April 2015 to April 2016, for example, all paper returns should be submitted by 31 October 2016. If you are not registered to file your tax return online you have already missed the deadline for paper returns. Contact us on 01677470780 if you are worried in any way about your tax submissions. Ask for Jenny. I can help.

-

-

-

-

/ 0 Comments